Broadly speaking, our activities can be grouped into proprietary research and client-support functions. In our proprietary research, we ask questions that help us uncover megatrends that eventually generate alpha and, in our client-support functions we answer questions in ways that are not only clear, concise and robust but also showcase our credibility which in turn arise from thoughtful, timely and rigorous work.

The 5 sections below however give a more detailed view of what we do.

Advisory

It is called advisory but in truth, we don’t like giving advice. What we give clients is information and perspective because we recognize that every client’s portfolio has unique characteristics, constraint and return objective. To do this, we start out by adopting a market-focused broad-brushed approach to giving clients information and then tailor same to their unique circumstance to enable them make optimal decisions.

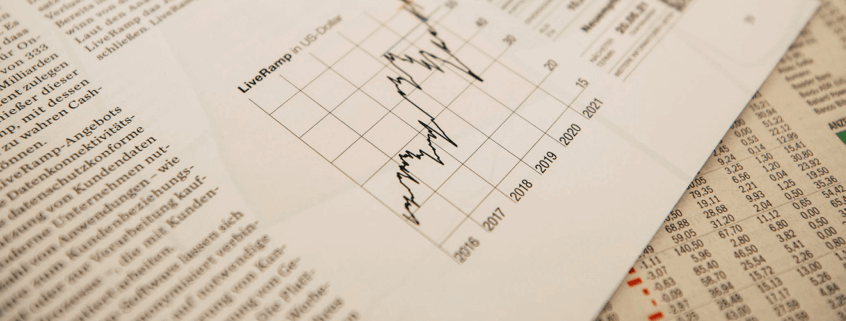

Trade Execution

- We accept and execute client’s trade mandate in both local and global OTC markets. Our objective upon receipt of a mandate is simple yet tasking certainty of execution at the best price.

- Leveraging our relationships both locally and internationally, we strive to constantly capture this elusive golden fleece to give our clients the best deal at all times.

- We are constantly developing new relationships and deepening older ones to ensure that we can continually improve this service offering to our robust and growing client base.

- Our product coverage includes a wide range of debt instruments issued by both corporates and sovereigns across the globe. The products include commercial papers, treasury bills, promissory notes, Naira-denominated bonds and Euro bonds.

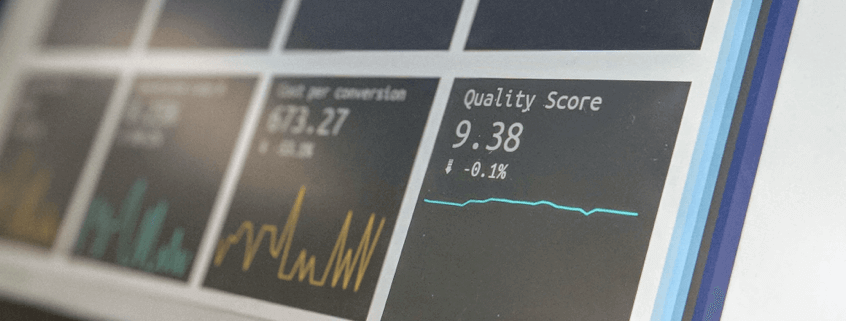

Proprietary Trading

- We are constantly seeking for ways to generate alpha across global markets. In every market we play in, our approach is hinged on developing frameworks that identify relative value that fall within our risk acceptance criteria and capture these opportunities using the most efficient trade structures.

- Our trading portfolios include both traditional assets and alternative assets. Traditional assets we cover include local and foreign equities and fixed income whilst the alternative assets include currencies, commodities and sports.

- We also trade indices, ETFs and options and this broad coverage opens us to a wide range of opportunities and helps us with diversifying unsystematic risk.

Venture Capital

- We are always on the lookout for “the next big thing” because we recognize that change is the only constant thing in nature. We position ourselves as a fair and dependable provider of capital to start up companies and small businesses that are demonstrating expertise in the conceptualization, appreciation and evaluation of stimulating ideas with strong long term potential.

- As at today, our private equity portfolio span across different industries including Esports, food and beverage, and hospitality services.

Treasury Management

- We assist small and medium scale businesses with robust treasury solutions to optimize their balance sheets and generate capital gains uncorrelated with their core business.